Trampoline Parks Are Under Pressure from Skyrocketing Insurance Costs

Operating a trampoline park in today’s risk landscape is becoming increasingly difficult. Insurance costs are surging, driven by high injury rates, legal settlements, and a tightening market where fewer insurers are willing to take on the risk.

As a result, many trampoline parks are facing general liability premiums exceeding $25,000–$50,000 annually. Some have even been forced into self-insurance when coverage is denied altogether.

“Small trampoline parks (under 5,000 sq ft) often pay $7,000–$10,000 per year. Medium parks (5,000–15,000 sq ft) range from $12,000–$25,000 annually, and larger venues often exceed $50,000.”

— Safe Kids Play, 2023

Source: https://www.safekidsplay.com/blog/trampoline-park-insurance-cost/

What’s Driving the Liability Explosion?

1. High Injury Rates

Trampoline parks are statistically high-risk environments. A study in Pediatrics found that injuries at commercial trampoline parks increased from 581 in 2010 to nearly 7,000 annually by 2014. Many of these injuries are severe, including fractures, spinal trauma, and concussions.

“Commercial trampoline parks have higher rates of orthopedic injuries compared to at-home use. Many injuries involve dislocations, spinal fractures, or concussions.”

— LaBotz et al., American Academy of Pediatrics

Source: https://pubmed.ncbi.nlm.nih.gov/25266430/

2. Shrinking Insurance Market

The availability of insurance for trampoline parks is shrinking rapidly. Carriers are either exiting the market or applying strict underwriting guidelines, often refusing to renew after even a single claim. This forces some operators to self-insure, which introduces significant financial risk.

“The market has hardened. Very few insurers are willing to write policies for trampoline parks due to the frequency and severity of injury-related claims.”

— Sadler Sports & Recreation Insurance

Source: https://www.sadlersports.com/trampoline-park-insurance/

3. Legal and Social Inflation

Insurers have also been impacted by a legal environment that is increasingly awarding large jury verdicts. According to Swiss Re, liability claims in the U.S. have grown 57% beyond inflation since 2013.

“Liability claims in the U.S. are rising dramatically due to more frequent litigation and larger verdicts… General liability premiums have followed suit.”

— Swiss Re Institute, 2024

Source: https://www.swissre.com/press-release/Litigation-costs-drive-US-liability-claims-by-57-over-past-decade-reveals-Swiss-Re-Institute/0b538159-9648-47da-a152-4550a7640d35

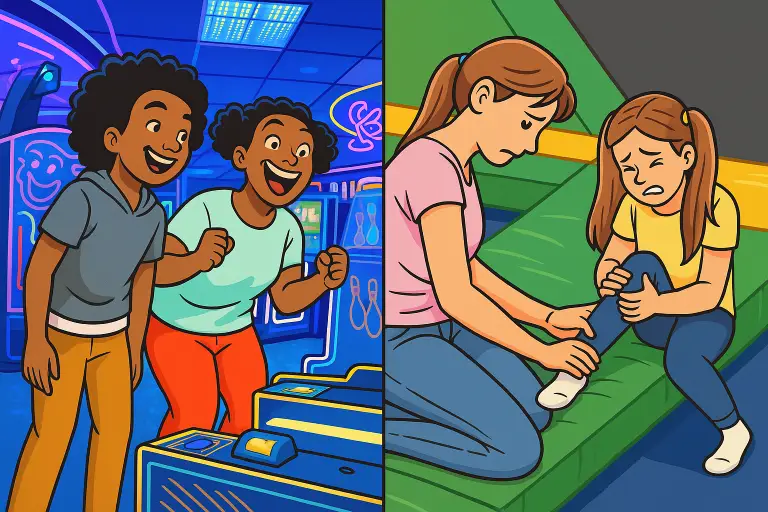

ClawCADE’s Low-Risk Model: No Active Attractions, No Liability Headaches

ClawCADE takes a different approach. Our model is built entirely around arcade-based entertainment: claw machines, redemption games, and digital amusements. There are no trampolines, no foam pits, and no physically strenuous activities that expose guests to bodily injury.

As a result, our insurance profile is substantially more favorable. We are not classified as a high-risk facility, and our coverage needs are limited to general liability and property insurance—policies available at a fraction of the cost trampoline parks face.

“If your facility does not include physically active attractions, the insurance premiums are exponentially lower. Typical arcade insurance falls under standard general liability packages.”

— XINSURANCE – Risk Class Analysis

Source: https://www.xinsurance.com/risk-class/insurance-for-trampoline-parks/

Strategic Advantages for Operators, Landlords, and Franchisees

For anyone evaluating a new entertainment concept—whether you’re an operator, property owner, or investor—ClawCADE offers clear benefits:

Significantly reduced insurance premiums

Simpler underwriting and compliance

No regulatory oversight from ASTM or state trampoline safety mandates

Greater financial predictability and operating margin stability

ClawCADE is not only safer for guests, but also safer for your bottom line.

Final Thoughts

Liability insurance is no longer a passive business cost—it’s a critical financial determinant in whether or not a business model can scale. Trampoline parks face a constant uphill battle with insurers, claims, and compliance.

ClawCADE was built with risk minimization in mind. By avoiding active attractions entirely, we offer a sustainable, scalable business with lower insurance overhead and higher long-term viability. It’s a better entertainment model—for owners and for guests.

Let’s Connect

If you’re an investor, landlord, or multi-unit operator looking to bring a low-risk, high-ROI family entertainment concept to your community, I’d love to share more about ClawCADE.

Visit franchise.claw-cade.com or send me a message to start the conversation.

References

Safe Kids Play. Trampoline Park Insurance Cost. https://www.safekidsplay.com

LaBotz et al., American Academy of Pediatrics. Injuries Associated With Trampolines. https://pubmed.ncbi.nlm.nih.gov/25266430/

Swiss Re Institute. Litigation costs drive US liability claims by 57%. https://www.swissre.com

Sadler Sports Insurance. Trampoline Park Insurance Overview. https://www.sadlersports.com

XINSURANCE. Trampoline Parks – Risk Class Analysis. https://www.xinsurance.com